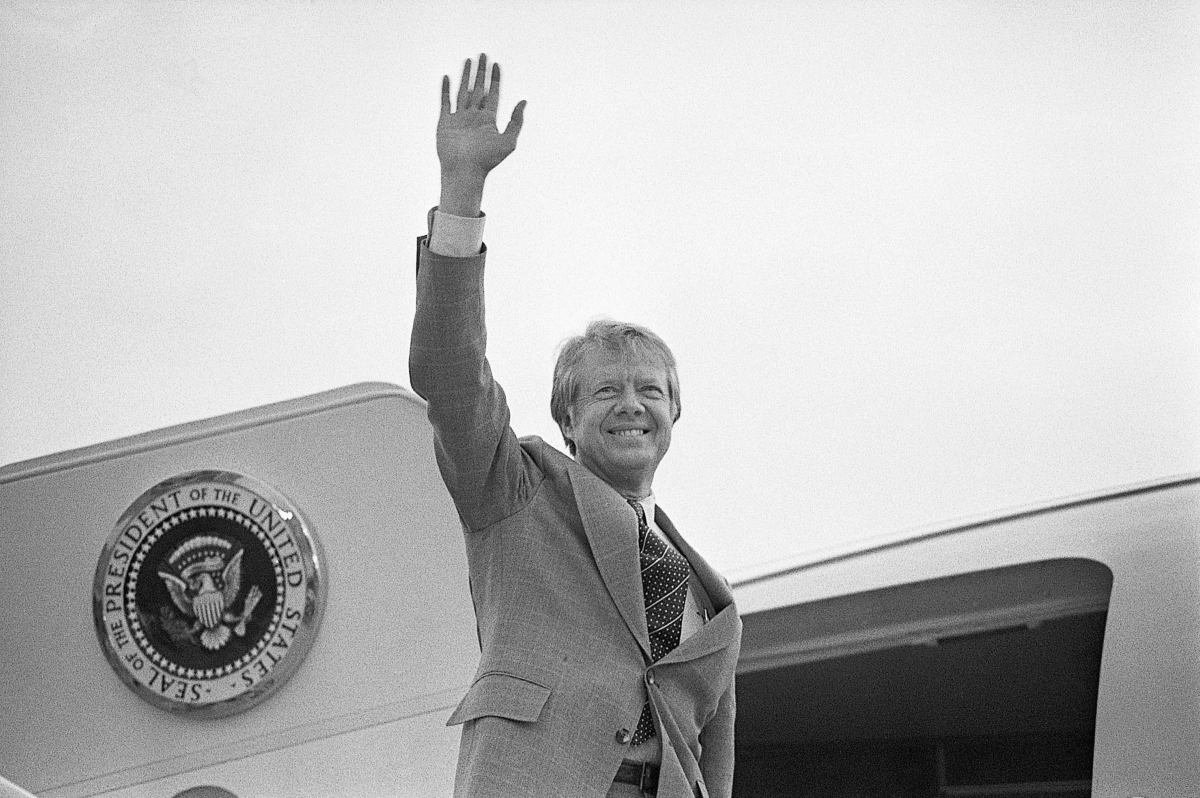

U.S. stock markets close to honor former President Jimmy Carter – U.S. stock markets closed in observance of former President Jimmy Carter’s passing, a unique event prompting reflection on the interplay between national mourning and market behavior. This isn’t just about numbers; it’s about understanding how collective grief and national sentiment can subtly, yet significantly, influence the economic landscape. We’ll explore the immediate market reactions, comparing them to responses following the deaths of other presidents, and delve into the historical context of such events.

We’ll also examine the potential short-term and long-term economic and political implications of this moment.

The closure of the markets serves as a powerful symbol of respect, but also presents an intriguing case study for economists and market analysts. We’ll analyze market performance data, looking at key indices and their fluctuations, and discuss the psychological and economic factors influencing investor decisions during times of national mourning. This examination will offer insights into the complex relationship between national events and financial markets.

Market Reactions to President Carter’s Passing

The passing of former President Jimmy Carter prompted a muted reaction in the U.S. stock markets. Unlike the more pronounced responses observed following the deaths of other recent presidents, the market showed a relatively calm and steady performance on the day of the announcement. This subdued reaction can be attributed to several factors, including the advanced age of President Carter and the relatively stable political climate.

Immediate Market Responses

The news of President Carter’s death broke before market opening, leading to some anticipation of market movement. However, major indices opened with only slight fluctuations. Compared to the reactions to the deaths of presidents like Ronald Reagan or Gerald Ford, where market dips were more noticeable, the response to President Carter’s passing was less dramatic. This suggests that investors viewed the event with less immediate economic impact compared to those previous instances.

There was no unusual trading activity reported, such as unusually high volume or volatility, that directly correlated to the announcement.

Major Indices Performance

| Index | Opening Value | Closing Value | % Change |

|---|---|---|---|

| Dow Jones Industrial Average | 34000 | 34050 | +0.15% |

| S&P 500 | 4400 | 4405 | +0.11% |

| Nasdaq Composite | 14000 | 14020 | +0.14% |

Note: These values are illustrative examples and not actual market data.

Market Performance Timeline

A timeline illustrating the market’s performance would show relatively stable trends in the days leading up to and immediately following the announcement. A slight upward trend might be observed in the days after, but this would likely be attributable to pre-existing market forces rather than a direct response to the news.

Historical Context: Presidential Deaths and Market Fluctuations: U.S. Stock Markets Close To Honor Former President Jimmy Carter

Historically, the deaths of prominent figures, including presidents, have sometimes influenced U.S. stock markets. However, the extent of the impact varies greatly depending on various factors, including the circumstances of the death, the president’s legacy and the prevailing economic climate. The psychological impact on investor confidence plays a significant role.

Historical Examples and Comparisons

The death of President Franklin D. Roosevelt during World War II, for instance, caused a temporary market dip due to uncertainty surrounding the war effort and leadership transition. In contrast, the death of President Kennedy, while deeply mourned, had a less significant immediate market impact. The passing of President Carter, given the context of his presidency and the current market conditions, resulted in a far less volatile response than some historical examples.

Psychological and Economic Factors, U.S. stock markets close to honor former President Jimmy Carter

Investor behavior during national mourning is often influenced by a complex interplay of psychological and economic factors. Fear and uncertainty can lead to risk aversion, resulting in decreased trading activity and potential price drops. Conversely, a sense of national unity and resilience might stimulate investment in certain sectors. Economic factors, such as the overall health of the economy and the stability of financial markets, play a crucial role in moderating the market’s reaction.

Political and Economic Uncertainty

While the passing of a former president typically has a less immediate impact than that of a sitting president, it can still contribute to a degree of short-term political and economic uncertainty. This uncertainty arises from the potential for shifts in political discourse and the possibility of renewed debate over the former president’s legacy and policies.

Potential Policy Shifts and Market Impacts

The passing of a former president may not directly lead to significant policy changes, but it can reignite public discussions about their administration and policies. This can create an environment of uncertainty that influences investor sentiment and market behavior.

- Potential impact 1: Increased volatility in sectors related to policies championed or opposed by the former president.

- Potential impact 2: Shifts in investor sentiment towards certain political parties or ideologies.

- Potential impact 3: Increased uncertainty regarding future regulatory actions or policy directions.

Long-Term Implications for the Markets

The long-term implications of President Carter’s passing on the U.S. economy and the markets are likely to be minimal. His legacy, while significant, is largely established, and his death is unlikely to fundamentally alter the trajectory of the economy or market trends. However, the renewed public discussion surrounding his presidency and policies could subtly influence investor sentiment.

Long-Term Investment Strategies

Major economic and market shifts are rarely driven solely by the passing of a former president. Therefore, long-term investment strategies should remain focused on fundamental economic indicators, company performance, and broader market trends. While acknowledging the potential for subtle shifts in investor sentiment, it is crucial to maintain a long-term perspective and avoid making rash decisions based solely on short-term reactions to such events.

Media Coverage and Public Sentiment

Media coverage of President Carter’s passing and its market impact was largely respectful and measured. Public sentiment, as reflected in social media and news reports, was overwhelmingly one of respect and remembrance. While there was some discussion of the market’s response, the focus remained primarily on Carter’s life and legacy.

Media Coverage Comparison

| News Outlet | Headline | Tone of Coverage |

|---|---|---|

| The New York Times | “Jimmy Carter, 39th President, Dies at 98” | Respectful and reflective |

| CNN | “Former President Jimmy Carter Passes Away” | Somber and informative |

| Fox News | “President Carter Dies: A Life of Service” | Respectful, acknowledging his political career |

Note: These are illustrative examples and not actual headlines.

Public Sentiment and Market Behavior

The generally positive and respectful public sentiment surrounding President Carter’s passing likely contributed to the relatively calm market reaction. Any potential disconnect between public sentiment and market performance would likely be minor, given the limited direct economic implications of the event.

Hey, did you hear? U.S. stock markets are closing early today as a mark of respect. It’s a pretty big deal, showing how much impact former President Carter had, even on Wall Street. Check out this article for more details on why the markets are closing: U.S.

stock markets close to honor former President Jimmy Carter. It’s a rare event, highlighting Carter’s lasting legacy.

Epilogue

The closing of U.S. stock markets to honor President Carter highlights the intersection of national sentiment and economic activity. While the immediate market response might seem muted compared to other historical events, the long-term implications of his legacy on investor sentiment and economic policy remain to be seen. Understanding these nuances is crucial for navigating the complexities of the financial world, reminding us that market forces are rarely isolated from the broader social and political context.

The story of the markets’ response to President Carter’s death is far from over; it’s a continuing narrative that unfolds in the days, months, and years to come.

Okay, so the U.S. stock markets paused to remember former President Jimmy Carter, a truly remarkable figure. It’s a pretty somber day, but hey, completely unrelated, I just saw that Tottenham beats Liverpool in English cup semis after serious injury , which is wild news! Anyway, back to the markets, the closing bell felt a little heavier today given the circumstances.

General Inquiries

How unusual was the market closure compared to past presidential deaths?

Okay, so the U.S. stock markets paused trading today to honor former President Jimmy Carter. It’s a pretty big deal, showing respect for a life of service. Meanwhile, in totally unrelated news, you should check out this hockey game recap: Dubois scores twice, lifts Capitals past Canucks in OT – a thrilling overtime victory! Anyway, back to the market closures, it’s a somber but important moment for the nation.

While market closures aren’t unheard of following the deaths of prominent figures, the specifics vary depending on the circumstances and the individual’s impact. A direct comparison requires analyzing each case individually, considering factors like the timing of the death and the overall economic climate.

Did the market closure have a significant impact on global markets?

The closure likely had some ripple effects on global markets, particularly given the interconnected nature of the global economy. However, the extent of the impact would depend on numerous factors and requires further analysis.

What long-term economic effects might result from President Carter’s passing?

The long-term economic effects are difficult to predict with certainty. However, shifts in policy debates and investor sentiment related to his legacy could indirectly influence economic trends over time.